The steel industry operates in one of the most dynamic and unpredictable markets in the world. Shifts in demand, swings in raw material costs, regulatory changes, and geopolitical shifts can all impact pricing and supply. For steel producers, service centers, and manufacturers, these variables can create uncertainty and expose businesses to significant risk.

That’s why a customized price risk management strategy is essential. By employing advanced tools and proactive planning, companies can protect margins and maintain stability, even when markets are volatile.

Understanding Price Risk in the Steel Industry

Price risk management in the steel industry begins with identifying and prioritizing the threats that affect profitability.

Common risks include:

- Volatility in raw material prices

- Shifts in global demand due to economic cycles

- Changes in trade policy or tariffs

- Supply chain disruptions and logistics challenges

The goal is straightforward: minimize potential losses from these uncertainties while enabling sustainable, long-term growth.

An Effective Risk Management Strategy

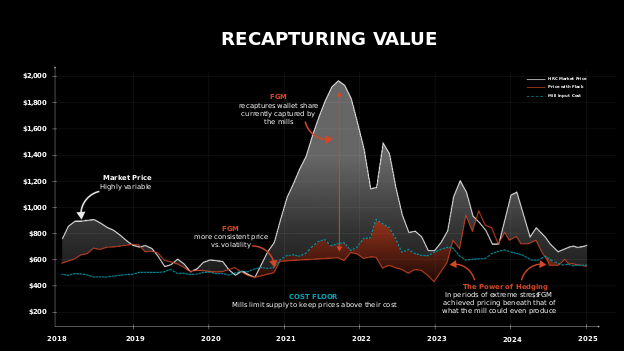

One of the most effective risk management tools is hedging. In the steel industry, hedging typically involves leveraging financial instruments such as futures, swaps, or options to lock in pricing for steel or raw material.

Hedging is not speculation; it is protection. This approach allows companies to secure predictable costs, focus on operations, and avoid reacting to every market swing. For example, a futures contract can lock in prices for finished steel, ensuring consistent margins even if raw material costs spike.

While this approach is highly effective, many steel-consuming companies lack the internal expertise or resources to implement it on their own. Forward-thinking distributors like Flack Global Metals (FGM) integrate these tools directly into their procurement and distribution models. Through its dedicated capital markets desk, FGM extends this expertise to other distributors and manufacturers, providing tailored strategies that strengthen their risk management approach.

Key Benefits of Price Risk Management

- Protection Against Price Fluctuations

By establishing positions, steel-consuming companies can shield margins from sudden swings in raw material or finished product pricing, especially when quoting long-term projects. This stabilizes margins and reduces financial stress. - Preservation of Capital

Stable pricing reduces unexpected losses, freeing capital for reinvestment in equipment, innovation, and growth. - Greater Flexibility

With pricing volatility under control, companies gain freedom to make operational decisions and adapt to shifting demand or supply challenges without being forced into reactive moves. - Stronger Customer Relationships

Consistent pricing builds trust. Companies that can provide predictable quotes position themselves as reliable partners, strengthening long-term customer relationships.

The Future of Price Risk Management in Steel

Technology is transforming how steel companies manage risk. Advanced analytics, artificial intelligence, and real-time data tracking make it possible to anticipate trends and make proactive decisions. As volatility continues, the ability to combine traditional hedging tools with modern technology will become a key competitive advantage.

How Flack Global Metals Can Help

At Flack Global Metals, we believe risk shouldn’t control your business—it should fuel your strategy. By combining steel distribution expertise with advanced risk management tools, we help our customers lock in pricing, protect margins, and plan with confidence. Turn volatility into opportunity with Flack Global Metals. Contact us today to learn how tailored hedging and risk management solutions can protect your business.